Social Security Fairness Act Awaits Senate Decision: What’s Next?

Below the radar of virtually every other current major news event, efforts are building to line up a Senate vote on the Social Security Fairness Act, which recently passed the House with rare bipartisan support. But the bill has only a small six-week window in which to pass.

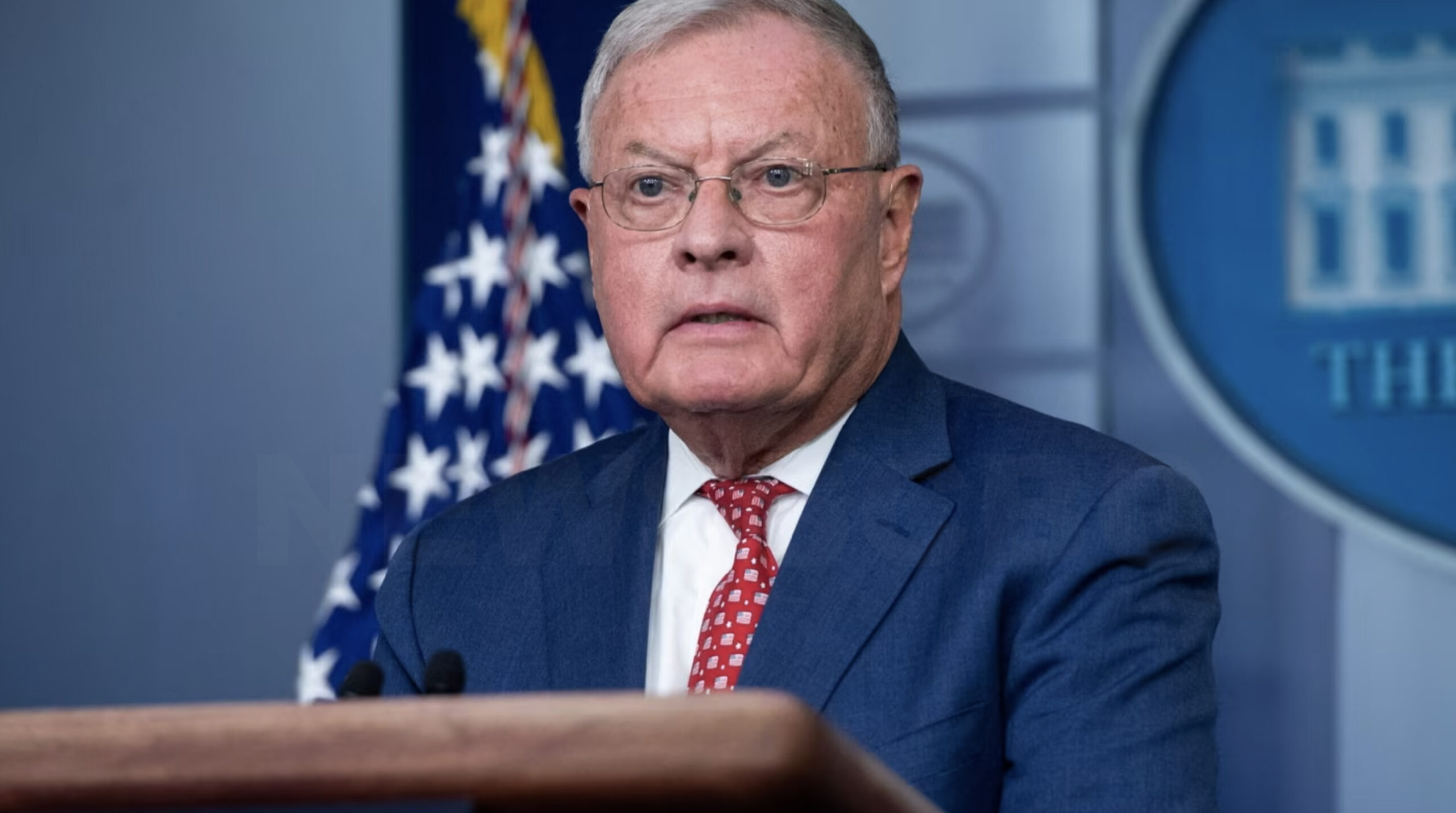

Shannon Benton of TSCL, a leading advocacy group for retirement benefits, was more guarded: “There is a great deal of potential.” If this doesn’t succeed at this point, a lot of people will become very pessimistic.

The law aims to abolish outdated provisions that withhold part of the Social Security benefits of some retirees who receive pensions from jobs that were not covered by Social Security. These include state and federal employees such as teachers, police officers, and postal workers. The proposed law would also abolish the other provision that withholds part of the Social Security benefits paid to the spouses and dependents of such workers.

The same bill versions have not been passed after being sponsored for several years. Benton went on to say that, in his 25 years of operation in the league, he could not recall any year this or a similar proposal had not been brought forth.

The bill, introduced by Abigail Spanberger (D-VA) and Garret Graves (R-LA) passed the House with an impressive 327-75 vote Tuesday evening after the ultra-conservative House Freedom Caucus defeated the legislation from advancing.

Table of Contents

Who Does It Affect?

The WEP affects approximately 2 million Social Security recipients, and the GPO affects an estimated 800,000 retirees.

Advocates and allies urge quick action by the Senate because passage of the bill would constitute a significant victory for retirees and their families.

What’s Next for the Social Security Fairness Act?

Having 62 co-sponsors in the Senate is still not enough as action by Senate leadership is needed to bring the Social Security Fairness Act to a vote.

Shannon Benton reports, “The bill has a deadline in stone: ‘The bill will expire on December 31, ending Congress’s second session.’ Not only would it have to begin again, but a new individual would have to bring it back.”.

The sense of urgency is heightened because some key legislator sponsors, like Senator Sherrod Brown, D-OH, either opted not to seek re-election or were defeated in their efforts for another term.

Chances of Passage

If the Senate votes on the bill, it is certain to pass as it already enjoys more than enough support to surpass the needed majority, and then head to President Joe Biden for his signature.

Effect upon Enactment into Law

The changes, if implemented, would apply to the payments from Social Security starting after December 2023 and would be a significant change to the benefit calculation for so many U.S. citizens.

In addition, with bipartisan support and a countdown in place, the Senate is under pressure to act before the year ends.

What Does the Social Security Fairness Act Do?

The Social Security Fairness Act would abolish the Windfall Elimination Provision and the Government Pension Offset that lessen retirement advantages for public area people, their spouses, and survivors. These provisions “quite actually rob workers of benefits they have got paid into and earned,” Representatives Abigail Spanberger and Garret Graves said.

In a statement released on November 13, they said that Social Security funds have been sustained for over 40 years through benefits taken from many Americans who paid for them and deserve them.

Current Impact of WEP and GPO

1. Windfall Elimination Provision (WEP):

WEP lowers the Social Security benefits of workers who also get a public pension from a job not covered under Social Security. Example :

- Educators who do not earn Social Security through their public school work but pick up part-time or summer work covered by Social Security also often receive reduced benefits although they have worked in Social Security-covered employment long enough to be qualified for those benefits.

2. Government Pension Offset (GPO):

GPO reduces spousal and survivor benefits of workers who have served in federal, state, or local governments in jobs not covered by Social Security. It reduces qualified recipients’ benefits by two-thirds of the public pension, which essentially knocks out benefits in so many instances.

- For instance, if the husband gets a spousal benefit of $900 a month from Social Security but he actually gets a government pension of $1,000, his Social Security benefit would be reduced by $667 – leaving him with only $233 of his spousal benefit.

What Would Change Under the Act?

If the Social Security Fairness Act passes it would do away with both WEP and GPO. Using that example above, that person would receive the full $900 spousal benefit with no reductions due to their pension.

Support for the Act

Senator Elizabeth Warren (D-MA), an original creator of the bill, framed this change as, “Employees should be able to count on the pension they’ve earned.” It is time to pass the Social Security Fairness Act in order to protect government employees, their families, and people with disabilities from punishment for having different types of retirement income.

What Are the Chances of Passing this Social Security Fairness Act?

The overarching problem with advancing the Social Security Fairness Act is that it comes with a expensive price tag attached to it. According to an estimate provided by the Congressional Budget Office-the nonpartisan federal agency responsible for budget and economic projections-the legislation is projected to surpass $190 billion in costs over the next decade.

Shannon Benton, the chief executive officer of TSCL, admitted the cost: “This would be accelerating the drain on the combined trust funds by six months to a year while they are already in trouble.”

TSCL is supporting broad reforms in order to tackle the forecasted depletion of the program circa 2033-2034.

Key Challenges and Outlook

- Financial Burden: Without a clear financial plan on how to pay for the $190 billion in costs, many lawmakers might shy away from supporting this bill.

- Urgency: The bill draws growing bipartisan support and needs to be passed before Congress adjourns.

While there is solid bipartisan support for the bill, and it may have a chance of being approved if voted on, its financial implications are expected to be one of the main debating points amongst Senate members.

13 thoughts on “Social Security Fairness Act Awaits Senate Decision: What’s Next?”